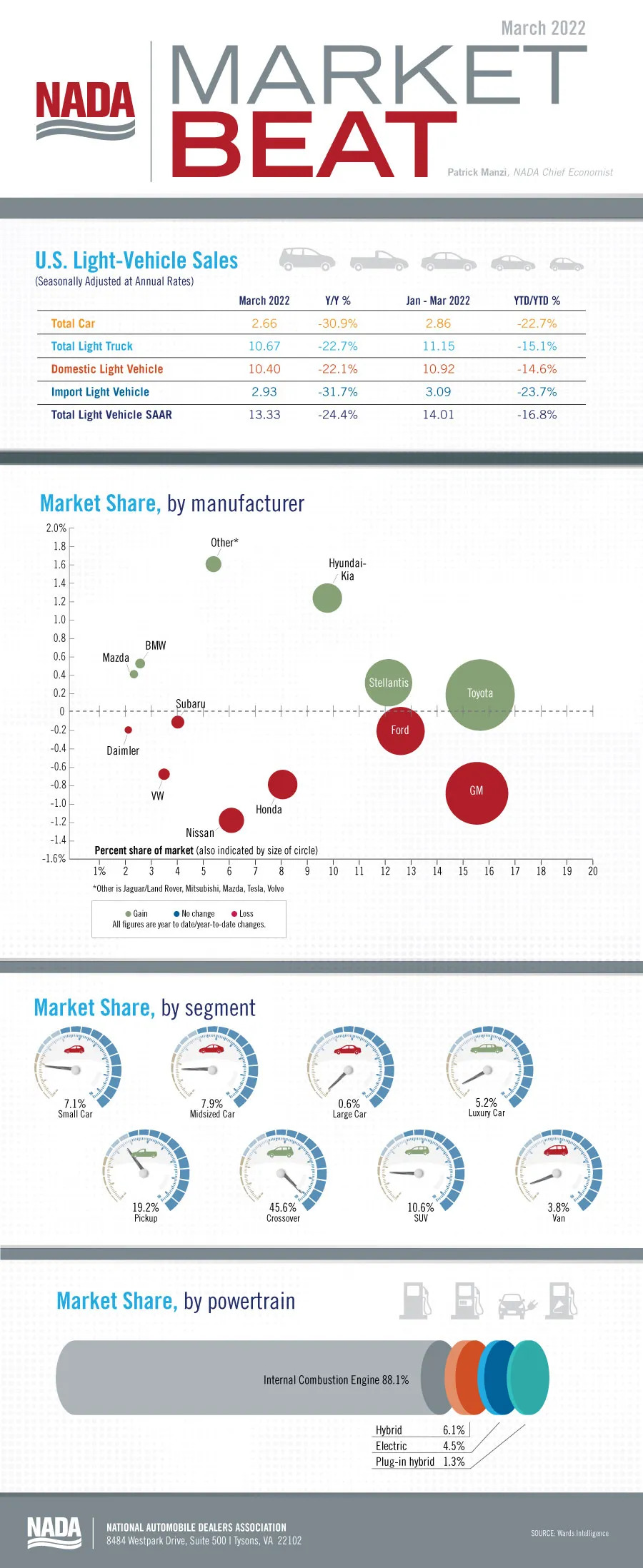

In March, new light-vehicle sales continued to be limited by available inventory. The month’s SAAR totaled 13.3 million units, down from 14 million in February and off 24.4% from March 2021’s SAAR of 17.6 million units. Sales fell throughout Q1 2022 as production that was already limited by scare microchips was further curtailed by global shocks from the war in Ukraine and continuing supply chain disruptions beyond microchips. Yet despite the low quarterly average sales rate of 14 million units in the first quarter, new-vehicle sales had their best quarter since Q2 2021.

Supply chain disruptions have prevented OEMs from utilizing full capacity in their final assembly plants. According to Wards Intelligence, the average production capacity utilization rate in a North American assembly plant in Q4 2021 was 70.3%, down from 85.4% in Q4 2020. As long as this continues, new light-vehicle inventory accumulation will remain sluggish.

High customer demand and very low inventory levels led OEMs to cut average incentive spending further in March. Average incentive spending per unit, according to J.D. Power, is expected to be an all-time low of $1,044 for March 2022, down 68.7% from March 2021. Both transaction prices and monthly payments increased in March. Average transaction prices, says J.D. Power, should achieve a March record of $43,737, up 17.4% compared with a year ago. The average monthly payment for a new vehicle will likely hit $658, an increase of 12.4% from March 2021. Average monthly payments haven’t risen as quickly as transaction prices because of elevated trade-in equity, which, for the average new-vehicle buyer, is expected to be up by 81.3% in March 2022 from a year ago.

For the rest of the year, new-vehicle sales will be limited by the number of vehicles OEMs can build. While our 2022 forecast of 15.4 million new light-vehicle sales remains unchanged from the start of the quarter, there are downside risks to our forecast from ongoing supply chain issues, global conflicts and pandemic-related impacts.