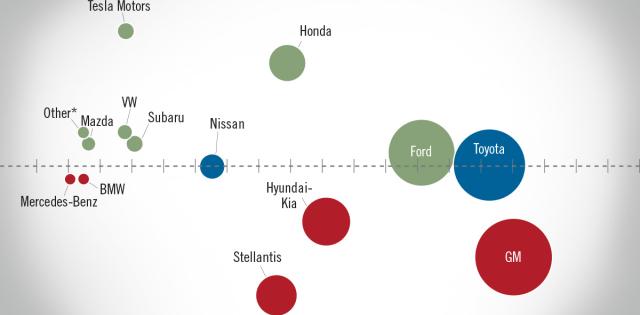

New light-vehicle sales increased for the fifth straight month in September. The September SAAR of 16.3 million units is the first time monthly sales have topped 16 million units since February 2020, though it represents a 4.3% decrease from September 2019. Through the first three quarters of the year, new-light vehicle sales are down by 19% compared with the same period in 2019. Raw sales volume in September totaled 1.34 million units, representing an increase of 6.1% from September 2019. The increase in September’s raw volume was due in part to the inclusion of the Labor Day sales weekend and two additional selling days compared with September 2019. But despite those calendar differences, consumer demand appears to be recovering from the extremely low demand in April 2020.

While retail sales are expected to post the first year-over-year monthly gain since February, fleet deliveries declined by an estimated 50%, according to Wards Intelligence. Incentive spending has also been reduced because of strong retail demand and tight inventory levels for new vehicles. According to J.D. Power, average incentive spending per unit is expected to total $3,964 per vehicle, down $250 per vehicle and below $4,000 per unit for the first time this year. Strong demand for light trucks continued in September, as did rising transaction prices. Average transaction prices are expected to be up by 5.6% in September and will likely reach another all-time high, according to J.D. Power. While all car segments saw sales declines compared with September 2019, sales of pickups, SUVs and crossovers all posted gains. So far this year, three out of every four vehicles sold have been light trucks.

Because of plant closures in the second quarter, automakers have had difficulty re-stocking inventory on dealer lots to pre-COVID levels. Model-year changeovers in auto plants have also put pressure on inventory levels, though we expect overall inventory to continue increasing through the fourth quarter. At the end of September, inventory on dealer lots totaled 2.66 million units—up 3.6% compared with August 2020 but down 26.7% compared with September 2019.

Consumers who took lease extensions in March, April and May will likely return to the new-vehicle market in the next few months, which should boost sales in the fourth quarter. Other tailwinds for the industry include low interest rates and improving consumer confidence. But job gains, while still positive, are slowing, and weekly jobless claims remain elevated compared with pre-pandemic peaks. There is also lingering uncertainty about the passage of another government stimulus bill. Overall, though, we remain optimistic about the new light-vehicle sales recovery for the rest of the year.