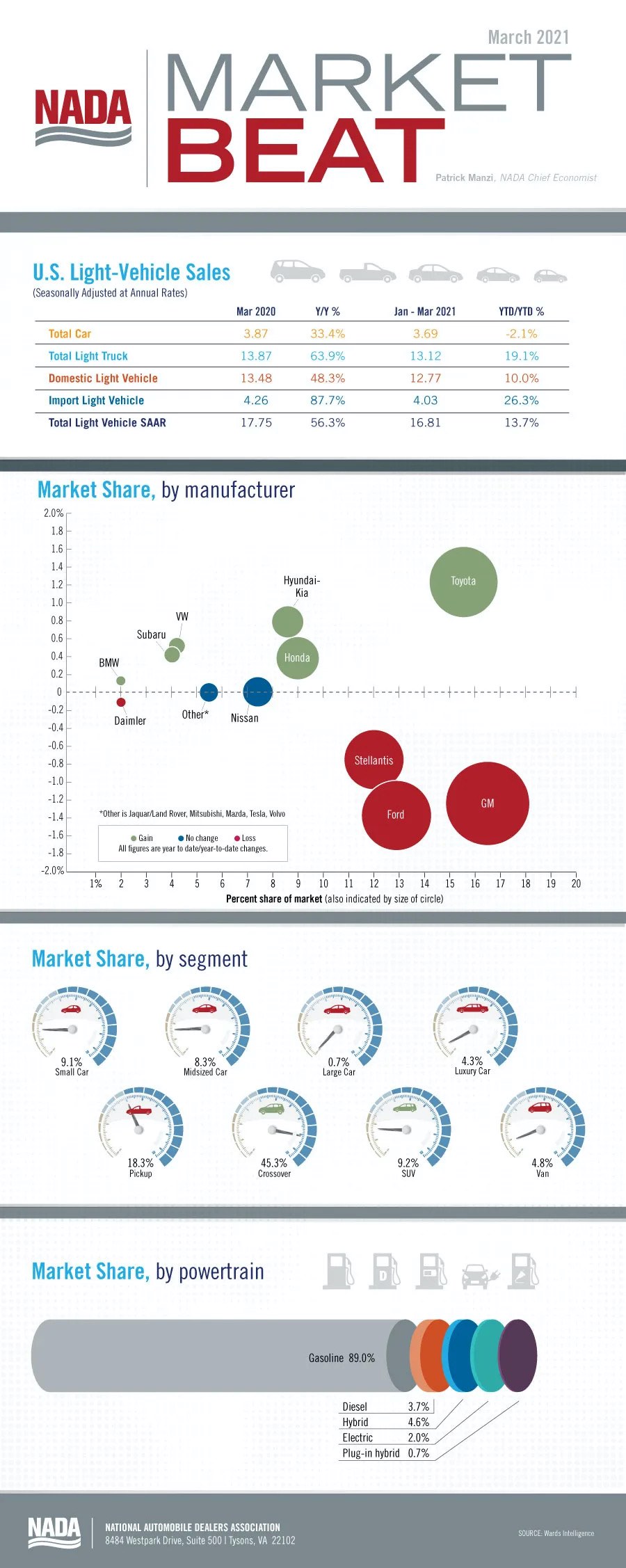

New light-vehicle sales in March 2021 were stellar. March’s SAAR of 17.75 million units is the second highest of all time for the month and just shy of March 2000. March 2021 sales were likely spurred on by delayed sales caused by severe winter weather in February and a boost from stimulus checks that began to hit consumers’ bank accounts following the passage of the Biden administration’s COVID-19 relief bill. Sales in first quarter 2021 equated to a SAAR of 16.8 million units, up significantly from the SAAR of 14.8 million units in Q1 2020—the first quarter affected by COVID-19. Sales in Q1 2021 came in just below the more typical SAAR of 16.9 million units in Q1 2019.

New-vehicle retail sales in March 2021 will most likely gain relative to both March 2020 and March 2019, while fleet sales continue to be depressed. Given disruptions to vehicle production from a semiconductor microchip shortage, reduced supplies of resins used in auto parts manufacturing and severe winter weather, manufacturers have prioritized production of the most popular, and profitable, segments for retail customers. In some cases, fleet customers have had their orders pushed back or canceled for the 2021 model year. The microchip shortage has had the biggest impact on vehicle production and will continue to hurt production in second quarter 2021. The impact from these production disruptions will likely reduce North American vehicle production in Q1 2021 by more than 300,000 units from expectations at the start of the year.

Because of robust retail demand, manufacturers have been able to dial back their incentive spending. According to J.D. Power, average incentive spending per unit is expected to total $3,527, a decrease of $888 and $262 relative to March 2020 and March 2019, respectively. Light trucks accounted for 77.7% of all new-vehicle sales in March 2021, up from 74% in March 2020. Lower discounting coupled with consumer preferences for higher-trimmed light-truck models should result in record-high transaction prices for March. Average transaction prices, says J.D. Power, are expected to reach $37,286, just below the all-time record transaction price set in December 2020. Tight new-vehicle inventories have led to rising values for used vehicles, which translates into higher trade-in values for consumers. Those higher trade-in values, along with low interest rates, mean that the average monthly finance payment in March 2021 is expected to increase by only $5 to $595, J.D. Power says.

Despite the challenges posed by production disruptions and low inventory, we are very optimistic about new-vehicle sales for all of 2021. Given the strong performance during the first quarter and our expectations for the rest of the year, we have increased our 2021 sales forecast to 16.3 million units.